Planning a colonoscopy and concerned about whether your private health insurance will cover the procedure? In this blog, we'll explore information around colonoscopies, the reasons why they are needed, and how private health insurance plans can be beneficial in managing the costs effectively. We'll also provide all the information around the waiting periods associated with private health cover for colonoscopies.

Understanding Colonoscopies:

A colonoscopy is a medical procedure where a doctor examines the large intestine using a colonoscope, a flexible tube with a light and video chip. This procedure serves various purposes, including screening for conditions without symptoms, diagnosing issues related to blood loss or changes in bowel habits, investigating abnormalities from other tests, and providing therapeutic measures like removing polyps. Given its importance in preventive healthcare, it's essential to understand how private health insurance plans can assist in covering the costs of colonoscopies.

Tips to Reduce Colonoscopy Costs:

No-Gap Schemes:

Explore private health funds that offer no-gap payments for hospital and specialist fees at specific hospital locations. This can significantly reduce out-of-pocket expenses.

Contact Your Private Health Fund:

Before making a claim, contact your health fund to get a list of doctors and specialists aligned with their gap cover agreements. This step can help you minimise gaps or potentially eliminate costs associated with various healthcare providers.

Shop Around for the Best Policy:

Prices for private health insurance plans vary from one provider to another. By researching and comparing policies, you can find the best private health coverage that suits your needs. Don't hesitate to seek assistance from experts in the field.

Estimating Costs for Private Health Patients:

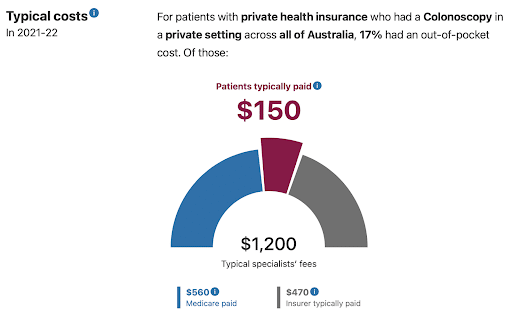

Go to the Government website Medical Cost Finder for an estimate of typical costs for private health patients. Understanding these costs will be helpful, before making an informed decision and whether your private health insurance covers the colonoscopy procedure.

Source: Medical Cost Finder

Public vs. Private System:

For public patients, Medicare will cover the entire cost of a colonoscopy but be aware the waiting times can be considerable. Whereas private health insurance provides an alternative with shorter waiting times and additional benefits. However, it's also important to be aware of waiting periods associated with your private health cover. Both could be vastly different.

Private Health Insurance Coverage for Colonoscopies:

Private health insurance plans categorise coverage into tiers (Basic, Bronze, Silver, and Gold). Colonoscopies fall under the treatment category 'gastrointestinal endoscopy,' starting from the Bronze tier. Private health insurance typically encompasses a wide range of expenses, including fees for services by a proctologist and anesthetist, as well as the expenses associated with the use of the operating theatre and hospital stay. It also takes care of consumables, in-patient consultations, and any prescribed medications, as long as you've already served the necessary waiting periods.

Waiting Periods for Colonoscopy Claims:

Most private health insurance policies require a two-month waiting period, or 12 months if deemed pre-existing, for a colonoscopy treatment. Also switching private health funds while maintaining the same cover generally doesn't require re-serving waiting periods. However, switching policies or funds before completing a waiting period may mean picking up where you left off.

Being well-informed about your private health insurance options for colonoscopies is crucial for managing costs and ensuring timely access to healthcare services. By simply understanding waiting periods, considering the tips provided here, estimating potential costs you can make an informed decision to find the best private health coverage for your needs. If you have any specific questions or need assistance, our team is here to help. Feel free to call us at 1300 861 413 or email us at hello@health.compare