Hospital cover will vary from state to state and from private health fund to health fund. In 2019 the Government made reforms and introduced a system that saw private health hospital cover be brought under four tiers - gold, silver, bronze and basic. This allowed Australians to easily compare private health cover like for like and work out what cover best suited their stage in life.

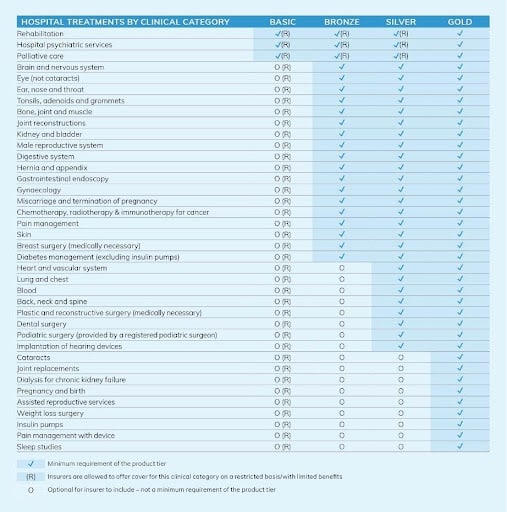

In addition the Government set requirements that each tier of hospital cover has a minimum list of treatment categories that they must include. If a health fund may choose to add the word ‘plus’ to their tier of hospital cover, this means they are offering more than the minimum treatment categories. For example: One private health fund may cover three more categories than the minimum requirement for that tier, therefore they are allowed to add the word ‘plus’ to their hospital cover tier name.

What treatment categories do the tiers of hospital cover offer?

Gold

With Gold Hospital being the highest level of cover, the Government set requirements that it must include cover for all 38 categories of treatment and services. It’s designed for people who are looking for the most comprehensive cover. If you are planning on having a baby, Gold Hospital is the only tier of cover where the pregnancy treatment category is included. All private health funds have pregnancy in their Gold Hospital coverage.

Silver

Silver hospital cover includes 29 categories and is the second highest tier of cover. There are some restrictions on this level of cover for hospitals such as rehabilitation, palliative care and psychiatric services. If you’re looking for more cover than Bronze hospital but don’t need all the treatment categories of Gold Hospital cover and price tag - Silver is a great middle of the road option.

Bronze

Bronze Hospital cover must include at least 18 treatment categories plus three restricted cover options for palliative care, psychiatric services and rehabilitation. The upside to Bronze cover you will be covered for hospital services such as ear, nose and throat, brain and nervous system and joint reconstructions.

Basic

Basic Hospital is the minimum coverage tier a health fund can offer. With basic hospital cover you will only receive very minimal benefits as set out by the Government. It is best to check what you are covered for before entering hospital as you may have a large amount of out-of-pocket expenses.

Product tiers and minimum clinical categories set out by the Government:

Source: Health.gov.au

Will I have to pay the Medicare Levy?

You will only have to pay the Medicare Levy if you do not have private hospital cover. The surcharge is in place to encourage individuals to take out private health cover.

The surcharge covers you and your dependents. Your dependents include:

- your spouse;

- any of your children who are under 21 years of age; or

- any of your full-time student children who are under 25 years of age.

The Medicare Levy Surcharge (MLS) is determined based on a percentage ranging from 1% to 1.5% of your income. This surcharge is an additional cost imposed in conjunction with the standard 2% Medicare Levy, applicable to the majority of Australian taxpayers. To work out your yearly income for MLS and Rebate calculations, you may utilise the Private Health Insurance Rebate Calculator provided by the Australian Taxation Office (ATO) or reach out to the ATO directly for assistance.

Compare Policies

Remember to review your private health insurance requirements depending on your stage of life. Your policy may no longer be suited to you and the treatments you require. A few things to keep in mind when choosing a level of hospital cover is who will be covered, the medical care you need, the services or categories you require and if you are willing to keep your premium costs down by paying an excess.

Be sure to compare private health policies taking into account excesses, benefit limits and co-payments that all influence the total cost of treatments. You may find the cheapest policy is not the best policy for you and your needs.Talk to us today to compare private health cover and discover what level of hospital coverage you require - call us on 1300 861 413 or email hello@health.compare